Key Sectors Driving India’s Export-Import Growth: Insights Data

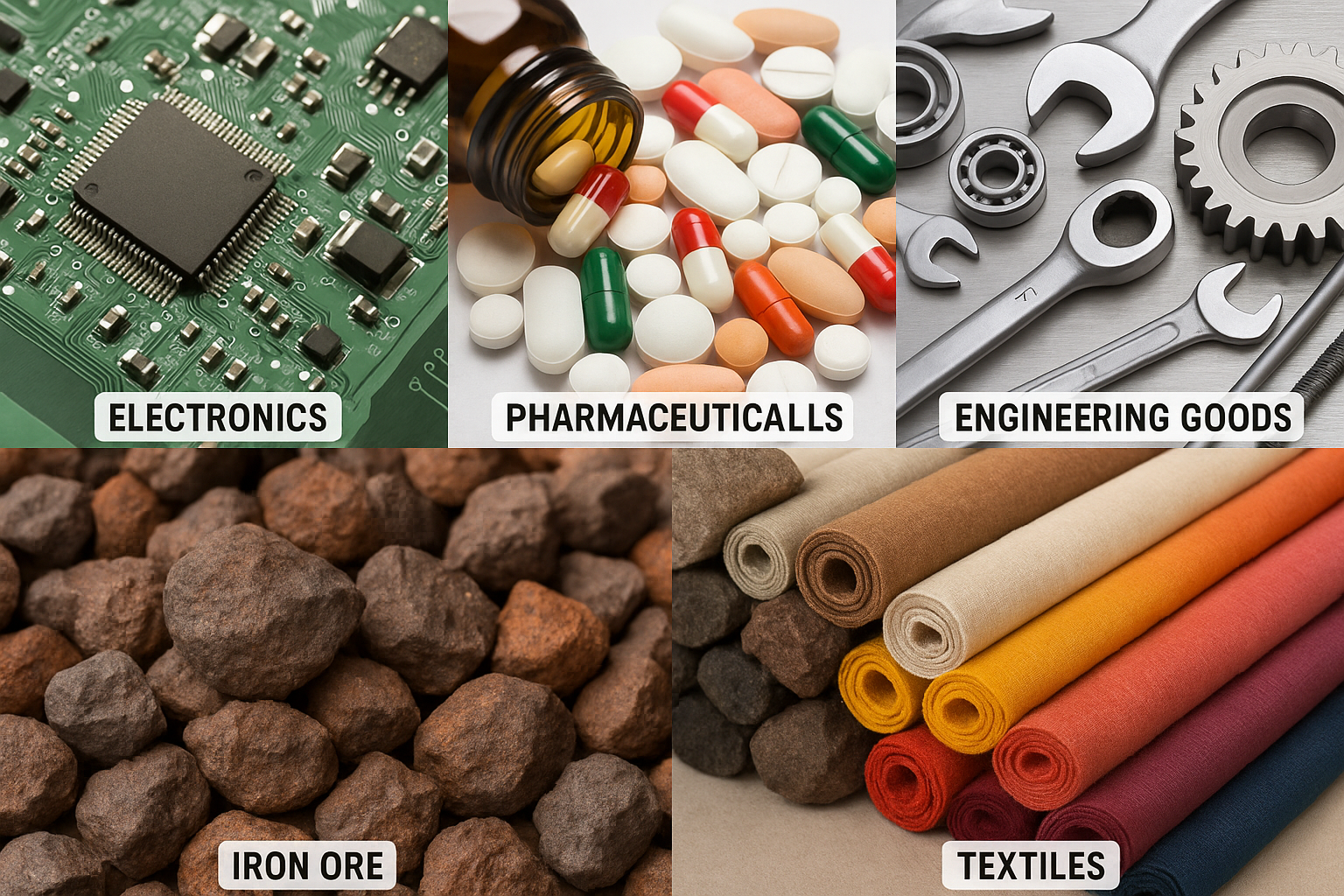

India’s international trade performance continues to evolve as key sectors play a defining role in shaping its export-import landscape. Among them, electronics, pharmaceuticals, engineering goods, iron ore, and textiles have emerged as the backbone of India’s global trade, contributing significantly to economic growth, employment, and foreign exchange earnings.

1. Electronics: Fastest-Growing Export Segment

The electronics sector has seen remarkable growth in exports, driven by rising global demand for mobile phones, consumer electronics, and semiconductor components. According to the Ministry of Commerce, India’s electronics exports reached USD 29.12 billion in FY 2023-24, marking a 23.6% increase over the previous fiscal year. Initiatives like the Production Linked Incentive (PLI) scheme and “Make in India” have boosted domestic manufacturing and export capabilities.

2. Pharmaceuticals: India’s Healthcare Powerhouse

India, known as the “Pharmacy of the World,” continues to dominate the global pharmaceutical market. In FY 2023-24, pharmaceutical exports stood at USD 27.9 billion, growing at 4.6% YoY, with the U.S., U.K., South Africa, and Brazil among the top export destinations. India is a major supplier of generic drugs, vaccines, and APIs (Active Pharmaceutical Ingredients), playing a crucial role in global healthcare supply chains.

3. Engineering Goods: Pillar of Industrial Exports

Engineering goods remain India’s largest export category. In FY 2023-24, the sector contributed USD 109.9 billion, accounting for nearly 26% of total merchandise exports. Products such as machinery, auto components, pumps, valves, and industrial equipment have seen growing demand from the U.S., UAE, Germany, and Southeast Asian countries.

4. Iron Ore: Raw Material for the Global Steel Industry

India exported USD 3.52 billion worth of iron ore in FY 2023-24, primarily to China, Japan, and South Korea. The demand has remained steady due to infrastructure projects and steel production needs. Although the sector faces regulatory and environmental challenges, it continues to contribute to India’s raw material exports.

5. Textiles and Apparel: Traditional Strength with a Global Reach

The Indian textile industry, rich in heritage and skill, remains a vital sector for exports. In FY 2023-24, textile and apparel exports reached USD 30.3 billion, with the U.S., European Union, and the Middle East being major markets. The government’s support via the RoSCTL (Rebate of State and Central Taxes and Levies) scheme and integrated textile parks has helped strengthen the sector’s competitiveness globally.

Conclusion

India’s export-import performance is closely tied to these high-impact sectors. While global uncertainties and trade policy shifts pose challenges, the resilience and strategic importance of electronics, pharmaceuticals, engineering goods, iron ore, and textiles will continue to shape India’s role in global commerce. Policymakers and businesses must continue to invest in innovation, compliance, and capacity-building to maintain growth momentum and secure India’s position in the international trade ecosystem.