Demand for Calcium Carbonate Powder & Calcite Lumps: Industrial Applications, Top Exporters & Importers (Global)

Top Exporters & Importers (Global) – Demand for Calcium Carbonate Powder & Calcite Lumps

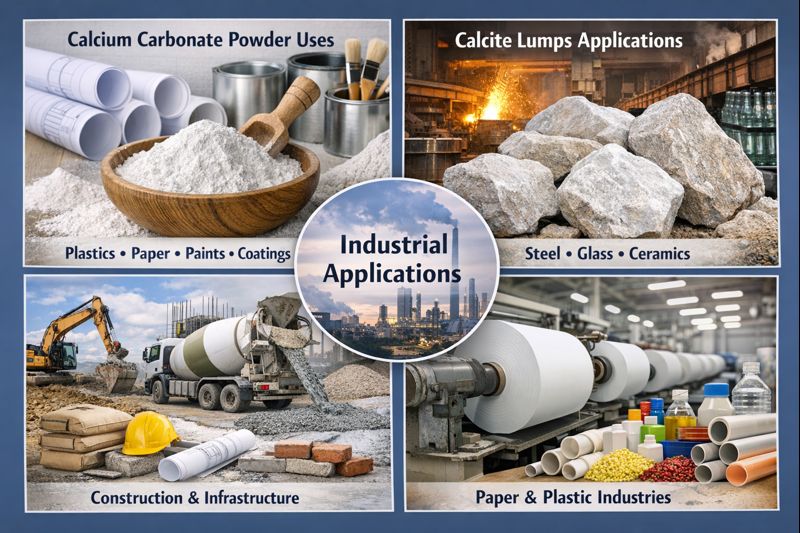

Calcium carbonate (CaCO₃) is one of the world’s most widely consumed industrial minerals because it works in two powerful ways: as a cost-effective extender/filler and as a performance enhancer (brightness, opacity, stiffness, rheology control, acid neutralization, and more). Demand is rising steadily with growth in construction, plastics, paper, paints/coatings, adhesives, and environmental applications.

1) What’s driving global demand?

Key demand drivers

- Construction & infrastructure: cement, lime, road base, building materials—still among the largest end uses of limestone/calcite forms.

- Plastics & polymers: CaCO₃ reduces cost per kg and improves stiffness, dimensional stability, and processing in PVC, PE, PP, masterbatches (especially GCC).

- Paper & packaging: brightness/opacity and coating performance (GCC & PCC) drive demand where paper and board output remains strong.

- Paints & coatings: improves sheen control, opacity contribution, and formulation economics.

- Environmental & chemical processing: neutralization, flue gas treatment, wastewater pH correction—important for industrial compliance.

Market size snapshot (for context)

Industry estimates vary by methodology, but recent reports place the global calcium carbonate market in the mid–tens of billions USD with growth continuing through 2030+.

2) Calcium Carbonate Powder vs. Calcite Lumps (Quick clarity)

Calcium Carbonate Powder (GCC / PCC)

- GCC (Ground Calcium Carbonate): mechanically ground natural calcite/limestone; commonly used in plastics, rubber, paints, paper.

- PCC (Precipitated Calcium Carbonate): chemically produced; more controlled particle size/shape; used where higher performance is needed (paper coating, premium plastics, pharma, specialty coatings).

Calcite Lumps

Calcite lumps are used when bulk mineral input or fluxing behavior is needed (rather than fine dispersion). Common in:

- Steelmaking / metallurgy as flux (impurity removal, slag formation)

- Glass & ceramics (raw material contribution and processing behavior)

- Construction aggregates and foundations (larger size uses)

3) Major industrial applications (where the volume goes)

A) Plastics, PVC pipes, masterbatch & rubber

- Cost reduction + improved stiffness/impact balance (depending on grade)

- Better dimensional stability; can improve processing characteristics

B) Paper, printing & packaging board

- Brightness and opacity (filler)

- Surface smoothness and printability (coating-grade GCC/PCC)

C) Paints, coatings, putty & adhesives/sealants

- Extender/filler to optimize formulation cost

- Rheology and finish control depending on particle size distribution

D) Construction, cement, lime & road base

- One of the oldest and largest uses: foundations, road building materials, cement/lime value chain

4) Top worldwide exporters & importers (trade snapshot)

For global trade benchmarking, a common reference product is HS 283650 (Calcium carbonate). (Note: “calcite lumps” may also move under different HS classifications depending on grade/size/end-use—so treat lump trade as more segmented.)

Top exporters (HS 283650, 2023)

From UN Comtrade/WITS and related trade datasets, leading exporters include:

- Egypt

- Belgium

- France

- China

OEC also lists Vietnam among the leading exporters for 2023, reflecting differences in how datasets aggregate reporters/partners and mirror statistics.)

Top importers (HS 283650, 2023)

Leading importers include:

- Germany

- India

- Indonesia

- United States

- Saudi Arabia

What this means commercially:

- Europe (Germany) remains a high-volume, quality-sensitive buyer market.

- India & Indonesia show strong demand tied to construction, plastics, paper, and manufacturing growth.

5) What buyers care about (specs that sell)

If you are marketing/exporting calcium carbonate powder or calcite lumps, buyers typically evaluate:

For powder (GCC/PCC)

- CaCO₃ purity / whiteness / brightness

- Particle size (D50/D97), PSD consistency

- Oil absorption, moisture, bulk density

- Coating/treated grades (stearic acid coating) for polymer compatibility

- Packaging (25 kg/50 kg/1 MT jumbo), anti-caking handling

For lumps

- CaCO₃ and CaO equivalent, low silica/alumina/iron impurities (as required)

- Size range (10–30 mm, 30–80 mm, etc.), hardness, low fines

- Consistency for kiln/metallurgical feed, glass batch behavior

6) High-opportunity regions and segments

- India, Indonesia, GCC countries: ongoing industrialization + infrastructure + polymer growth.

- Specialty PCC: coatings, high-end paper, and performance plastics (value per ton tends to be higher).

- Construction-linked grades: sustained demand where infrastructure spends remain strong.

The “why now” for exporters

Calcium carbonate powder and calcite lumps sit at the center of multiple mega-industries—construction, plastics, paper, paints, glass, and metallurgy—which makes demand resilient. The exporters who win consistently are the ones who combine spec discipline (consistent PSD/whiteness/low impurities) with reliable logistics and documentation, plus clear positioning by end-use (PVC, paper coating, paint extender, steel flux, glass raw material).