Revolving Letter of Credit (L/C): Uses in Merchant Export and Key Benefits

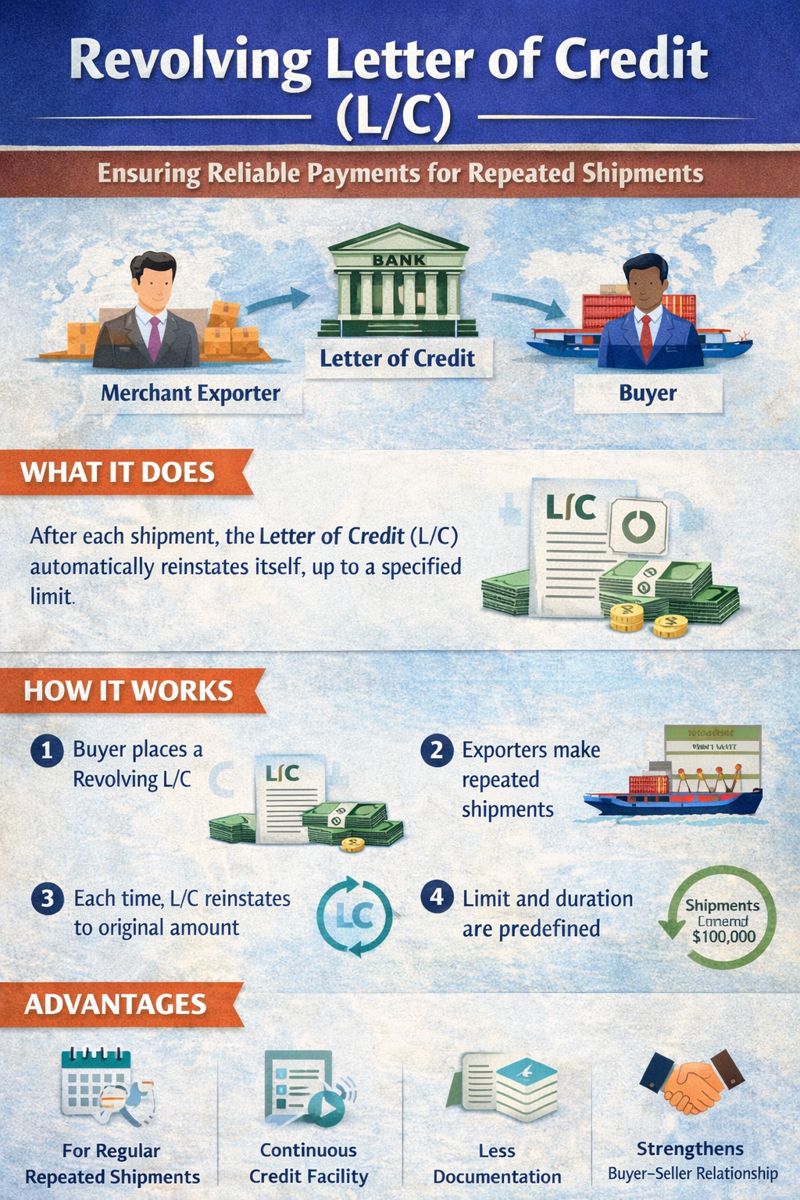

In international trade, payment security and working capital efficiency are critical for merchant exporters who deal with repeated shipments and multiple overseas buyers. Among the various trade finance instruments, the Revolving Letter of Credit (Revolving L/C) plays a vital role in simplifying regular export transactions and strengthening long-term buyer–seller relationships.

This article explains the concept, uses, and practical benefits of Revolving Letters of Credit, especially in the context of merchant exports.

What Is a Revolving Letter of Credit?

A Revolving Letter of Credit is a type of documentary credit that automatically reinstates its value after each utilization, without the need to open a fresh L/C for every shipment.

It is commonly used when:

- The exporter makes regular shipments

- The buyer places repetitive orders

- The trade relationship is long-term and stable

Revolving L/Cs can be structured:

- By value (amount reinstated after each draw)

- By time (renewed monthly, quarterly, etc.)

- As cumulative or non-cumulative

Why Revolving L/C Is Ideal for Merchant Exporters

Merchant exporters typically operate on:

- Thin margins

- High volume transactions

- Repeated shipments to the same buyer

Opening a separate L/C for every shipment increases:

- Bank charges

- Documentation workload

- Processing delays

A Revolving L/C offers a continuous credit facility, making it a preferred instrument in merchant export operations.

Key Uses of Revolving L/C in Merchant Export

1. Regular Shipment Programs

Ideal for exporters supplying goods on a monthly or periodic basis such as:

- Textiles & garments

- Engineering goods

- Auto components

- Agro-commodities

- Chemicals & raw materials

2. Long-Term Buyer Contracts

When exporters sign annual or multi-shipment contracts, revolving L/Cs avoid repetitive L/C openings and simplify execution.

3. Working Capital Planning

Since credit is automatically restored, exporters can plan production, procurement, and dispatch schedules more efficiently.

4. Multiple Drawings Under One L/C

Merchant exporters can negotiate documents multiple times under a single L/C limit, reducing operational complexity.

Types of Revolving L/C Structures

By Value

Example:

L/C value: EUR 100,000

After shipment of EUR 25,000 → Balance resets to EUR 100,000

By Time

Example:

EUR 50,000 per month for 12 months

Cumulative

Unused portion carries forward to the next period

Non-Cumulative

Unused portion lapses if not used within the period

Major Benefits of Revolving L/C for Merchant Exporters

✅ 1. Reduced Administrative Cost

No need to open a fresh L/C for every shipment

Lower bank charges and documentation fees

✅ 2. Faster Transaction Execution

Shipments proceed smoothly without waiting for new L/C issuance

Improves delivery reliability and buyer satisfaction

✅ 3. Improved Cash Flow Management

Continuous availability of credit ensures:

- Timely negotiation

- Predictable cash inflow

- Better inventory planning

✅ 4. Strengthens Buyer–Seller Relationship

Reflects mutual trust and long-term commitment, encouraging stable trade partnerships.

✅ 5. Lower Operational Risk

Bank payment assurance remains in force across multiple shipments, reducing:

- Payment default risk

- Country risk exposure

Precautions and Best Practices

While Revolving L/Cs are highly useful, exporters must carefully monitor:

🔹 Overall credit limit

🔹 Shipment frequency and validity periods

🔹 Cumulative vs non-cumulative terms

🔹 Country and issuing bank risk

🔹 Expiry and reinstatement conditions

It is advisable to:

- Obtain confirmation for high-risk countries

- Clearly define reinstatement clauses

- Monitor utilization through regular bank statements

When Should a Merchant Exporter Use Revolving L/C?

Revolving L/C is most suitable when:

✔ Buyer is reliable and financially stable

✔ Shipments are frequent and of similar value

✔ Long-term supply contracts exist

✔ Exporter wants predictable cash flow

✔ Administrative efficiency is important

Conclusion

For merchant exporters engaged in continuous international supply, the Revolving Letter of Credit is a powerful trade finance tool that combines payment security, operational efficiency, and financial flexibility.

By reducing repetitive documentation, ensuring continuous credit availability, and strengthening buyer relationships, revolving L/Cs significantly enhance the profitability and sustainability of merchant export