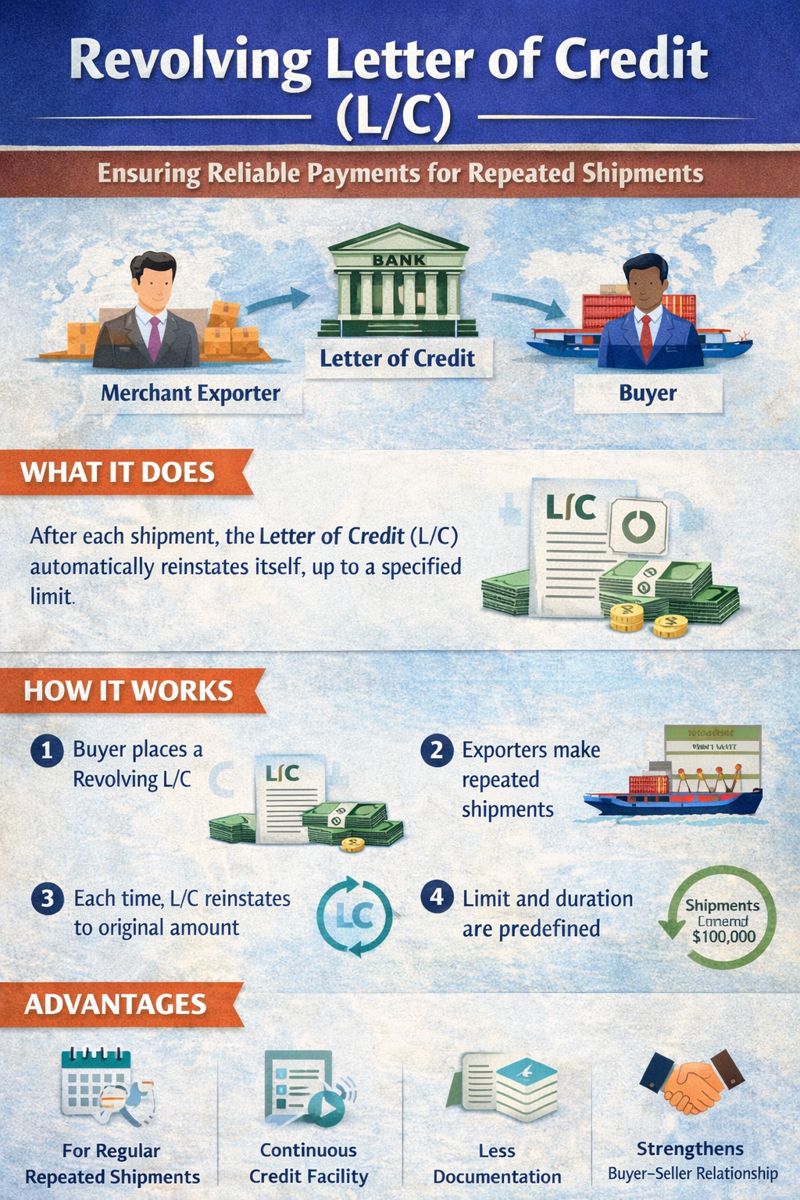

Revolving Letter of Credit (L/C): Uses in Merchant Export and Key Benefits

In international trade, payment security and working capital efficiency are critical for merchant exporters who deal with repeated shipments and multiple overseas buyers. Among the