Know About Export-Import – (Exim ) Documentation

Export-Import Documentations play a crucial role in facilitating international trade and ensuring smooth movement of goods across borders. The documentation process involves several legal and regulatory requirements that are mandatory to meet for both exporters and importers.

One of the primary reasons why export-import Documentation are important is that they provide legal protection to both parties involved in the trade. By following the required documentation procedures, exporters can ensure that their products meet the required standards and specifications of the importing country. Similarly, importers can ensure that the products they are receiving are of the desired quality and comply with their country’s laws and regulations.

Furthermore, Export Import Documentations help in minimizing the risk of fraud and misunderstanding during the trade process. The documents also help in keeping track of the movement of goods, ensuring that the products are delivered to the intended destination and that payments are made as per the agreed terms.

There are several types of documents that are required for worldwide export-import operations, including commercial invoices, bills of lading, packing lists, export licenses, and certificates of origin, among others. These documents serve different purposes, such as specifying the terms of the trade, providing proof of ownership, and attesting to the quality and origin of the products being traded.

In summary, Export Import Documentations are essential for ensuring the legality and smooth functioning of international trade. Without proper documentation, the trade process can be risky, costly, and prone to legal disputes, which can result in significant financial losses for all parties involved.

Read online Export Documentation e-Book

Get Export Import Documentations Premium Services

The export documents are classified into three major categories:

(A) Principal Documents

(B) Auxiliary Documents

(C) Documents for claiming Export Assistance

(A) Principal Documents :

Export Invoice: Types of Export Invoices

- Proforma Invoice:

- Combined Certificate of Origin and Value.

- Consular Invoice:

- Invoice Certified by a Recognized Chamber of Commerce

- Legalized Invoice

- Customs Invoice

Sample of Export Invoice

The following are the essential details which should be available in the invoice

- Name and address of the exporter

- Invoice number and date

- Buyer’s and Seller’s Order numbers

- Name and address of the overseas customer Name of the vessel and sailing date

- Unit price and total value

- Terms of payment

- Insurance reference

- Customs and consular declaration

- Shipping marks and numbers on packages

- Quantities and description of commodities

- Net weight and gross weight as well as measurement in metric units Specification of packing

- Terms of sale (FOB., CIC., C&F, FAS, etc,)

- Bill of lading number

- Letter of credit number and date.

- Import license number and date.

-

Marine Insurance

-

Central Excise ARE1

-

Bill of Lading : Sample of B/L

-

A Bill of Lading is a document issued and signed by a shipping company or its agents acknowledging that the goods mentioned in the bill of lading have been duly received for shipment, or shipped on board a vessel, and undertaking to deliver the goods in the same order and condition as received, to the consignee, or his order or consignee, provided that freight and other charges specified in the bill of lading have been duly paid.

-

Bill of Exchange

It is defined as “an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to which it is addressed to pay on demand or at a fixed or determinable future time a sum of money, to or to the order of a specified person, or to bearer”. The bill is called a sight draft if it is made out payable at sight i.e. on demand. If it is payable ‘at a fixed or determinable future time’ it is called term draft or usance draft because the buyer is receiving a period of credit, known as the tenor of the bill. -

GR/PP/VPP/COD forms

GRJPP/VPP/COD Forms are submitted to the customs authorities according to the exchange control regulations. Section 18 of the Foreign Exchange Regulations Act, 1973 and para 11 B. 1 of Exchange Control Manual 1987 states that all exporters other than those exporting to Nepal and Bhutan are required to submit a declaration in the prescribed form duly supported by such evidence as may be prescribed or so specified and true in all material particulars.

(B) Auxiliary Documents :

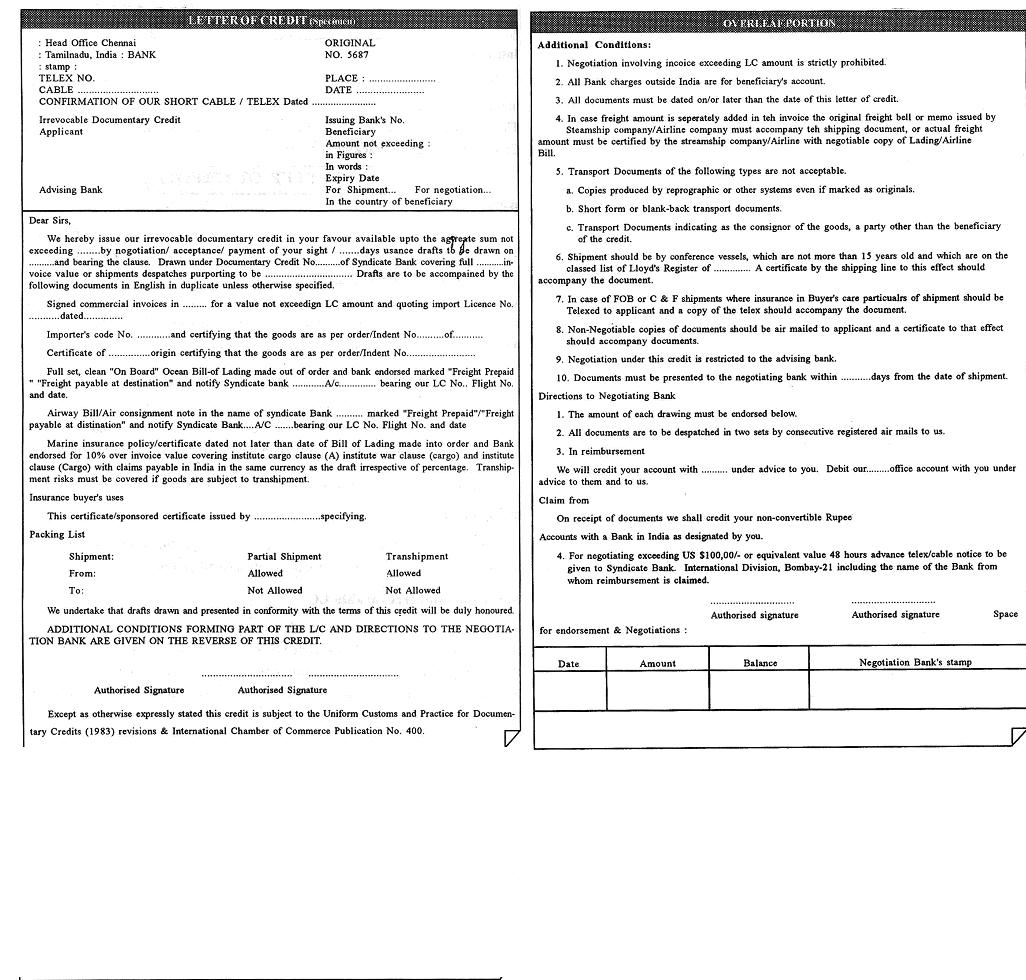

- Letter of Credit : A commercial letter of credit is issued by a bank at the request of a buyer of merchandise whereby the bank itself undertakes to honor drafts drawn upon it by the seller of the merchandise concerned.

- Types of LC :

a) Revocable and Irrevocable LC

b) Confirmed and Unconfirmed LC : A Confirmed LC carries the confirmation of another bank, generally, in the country of the exporter. LC Sight and Usance. Documentary credit may provide for payment at sight or for acceptance of a usance bill of exchange by either the issuing bank in a buyer’s country or the correspondent bank in the exporter’s country. If the LC is not an at-sight LC, it will be a usance LC.c) Transferable LC: A transferable LC is one which can be transferred by the beneficiary named therein favor of another party. See the sample of the Letter of Credit (L/c) -

Certificate Of Origin

A certificate of origin serves as evidence to show the actual country of origin of the goods. It is signed in the exporting country by the consul of the importing country or by the exporter or by the Chamber of Commerce on the basis of required regulation.

See the sample : -

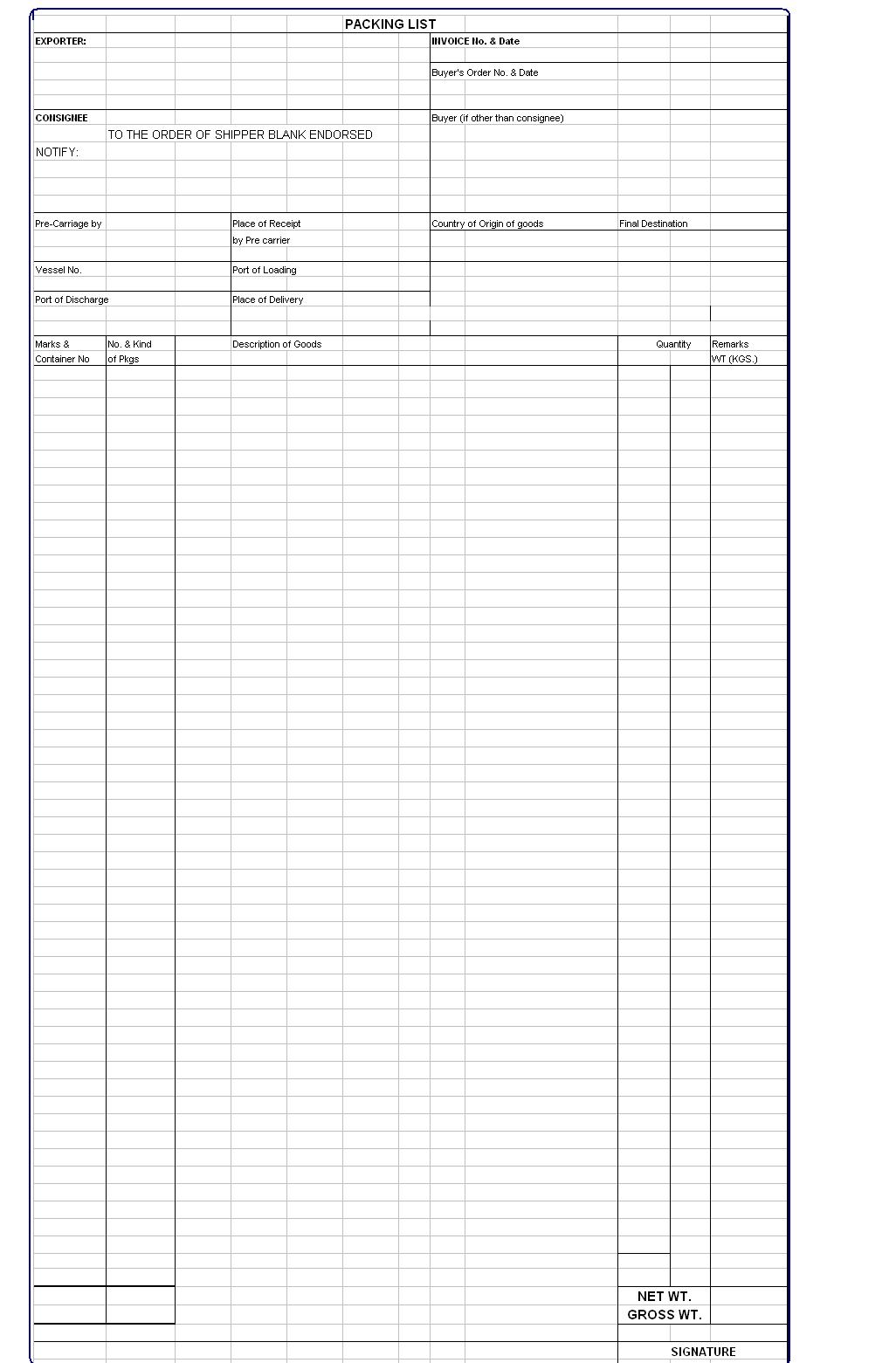

Packing List

The packing list should contain, item by item, the contents of cases or containers of a shipment, with its weight and description set forth in such a manner as to permit checks of the contents by the customs on arrival at the port of destination and by the recipient. The packing list must be made in accordance with the instructions of the customer. -

Inspection Certificate

As per the Export Act, of 1963, the exporter has to submit an application in the prescribed form in duplicate, sending the original to the Export, Inspection Agency and duplicate to the Export Inspection Council, seven days in advance of the expected date of shipment. -

Shipping Bill

The shipping bill is stamped by the customs that the cargo is allowed to be carted to the docks. -

Mate’s Receipt

The commanding officer of the ship will issue a receipt called the “mate’s receipt” for goods.

Despatch of Shipping Documents :

Through Banks: All shipping documents covering the export of goods from India must be submitted within 21 days from the date or export to the AD (mentioned in the relevant declaration form, except where the export falls within one of the exempted categories.

Direct to the importer in case of perishables: Railway receipts, steamer receipts, bills of lading, airway bills or any other document conveying title to the foods exported to Pakistan or Bangladesh may, where the exports consist of perishable commodities, be sent directly to the importer with the prior approval of the RBL. Clean bills in respect of such exports, if accompanied by the exporter’s invoice and duplicate and triplicate copies of the relative EP or GR form, may, if advised by the reserve Bank, be accepted for negotiation or collection by a banker.

Negotiation of Export Bill :

According to FEMA, within 21 days of shipment, the exporter should submit the export bill along with a duplicate of GR form to an authorized dealer for negotiation/ purchase/ collection.

The documents submitted to the bank should be sent under a cover letter giving a complete collection of instructions. Importantly, the letter should indicate:

-

The bank in the importer’s country through whom the bill be preferably sent for collection;

-

In the case of usance bills, whet her the documents are to be delivered to the importer on acceptance or on payment ;

-

Interest to be recovered if payment is delayed;

-

Whether bank charges abroad are to be borne by the importer or can be deducted from the proceeds of the bill.

Claiming of Export Incentives :

Wherever export incentives are available, the required form should be prepared and claims made with the appropriate authorities within the dates prescribed under the respective scheme. Claims made should be followed up to ensure the disbursal of incentives.

(C) Documents for claiming Export Assistance :

DEPB, Drawbak Rates and VKGUY mentioned in DGFT Ayaat Niryaat form of Foreign Trade Procedure 2009-2014.

Online Free Listing Directory of Export Import Companies, Trade Books, Import Export Database of Manufacturers, Traders & Suppliers

-

International Marketing & Export Consultancy Business Model

Service Packages To earn $500/day, you need productized consulting. 🔹 Package 1 – Market Entry Strategy (Core Product) Service Includes: Fee: $1,000 – $2,500 per

-

EximTutor: Empowering New Exporters & Importers for Global Entrepreneurship

In today’s globally connected economy, entering the world of export-import presents immense opportunities — but also complex challenges. Whether you’re an aspiring entrepreneur, a small

-

Export Import Case Study – FAQs

FAQs Based on This Type of Prospect Response Case Study 1: “Happy With Current Supplier”.Case Study 2: Price-Driven Buyer Converted Through Value StrategyCase Study 3:

-

EXIM Research Database

Your Gateway to Reliable, Real-Time Global Trade Intelligence The EXIM Research Database is a comprehensive, data-driven knowledge hub designed for exporters, importers, international traders, consultants,

-

New Export Business Opportunities in Poland

Poland 2025: Growing Economy Poland is rapidly emerging as one of the most dynamic economies in Europe, making 2025 a promising year for exporters looking

-

भारत में नए एक्सपोर्टर्स के लिए स्टेप-बाय-स्टेप गाइड

🌍गाँव से वैश्विक बाजार तक – कम बजट में एक्सपोर्ट बिज़नेस कैसे शुरू करें. भारत के ग्रामीण उद्यमी और छोटे शहरों के विज़नरी आज अंतरराष्ट्रीय

-

Guide for New Exporters in India

🌍 Step-by-Step Guide for New Exporters in India How to Start Export Business from Village to Global Market on a Low Budget India’s rural entrepreneurs

-

High Sea Sale

What is High Sea Sale (HSS)? High Sea Sale is a type of sale where goods are sold while still in transit on the high

-

Demystifying Indian Customs Duty Tariff Structures: A Comprehensive Guide for Importers

Navigating the complexities of Indian customs duty tariffs can be a daunting task for importers, especially with the various components and rates involved. Understanding these

-

Enhancing Paper Quality and Reducing Costs with QNM BRIGHT83 White Kaolin Powder

The paper industry, a cornerstone of modern communication, continually seeks innovations to enhance product quality while simultaneously optimizing production costs. In this pursuit, the use

-

Exim Tutor – Training Benefits

Welcome to EximTutor.com Best Import Export Website! The world of international trade is a vast and complex field, with many factors and variables to consider

-

How Digital and Artificial Intelligence Work for International Marketing and Sales Support?

In today’s globalized business landscape, international marketing and sales have undergone a significant transformation. Digital technologies and artificial intelligence (AI) are playing a pivotal role

-

Exporting Import ODEX Filing Guidelines

Exporting and importing goods to and from India can be a complex process that involves various regulatory requirements. One such requirement is the ODEX filling

-

Know How to Export Projects Exim Code Chapter 98

Exporting projects under Exim Code 98 can be a complex process, but it’s essential to ensure compliance with international trade regulations. In this guide, we’ll

-

Exports dip 6.6% to $33 bn in Jan; trade deficit at $17.7 bn

India’s trade deficit ballooned to $83.5 billion in FY22, a manifold rise from Covid-hit year of 2020-21 when it was $13.2 bn, shows govt data.

-

SCOMET Policy

ITC HS Code Based Import & Export SCOMET Policy Welcome to our informative guide on ITC HS Code Based Import & Export SCOMET Policy. In

-

RoSCTL Scheme

RoSCTL Scheme: Benefits for Indian Exporters and Importers The RoSCTL (Rebate of State and Central Taxes and Levies) scheme was introduced by the Indian government

-

RoDTEP Scheme in India

Know about RoDTEP Scheme in India and how exporters can benefit from it? The RoDTEP Scheme (Remission of Duties and Taxes on Exported Products) is

-

Rex Registration: How to Get the Benefits of a Rex Number for Exporting

If you’re involved in exporting goods from the European Union to countries that have preferential trade agreements with the EU, you’ve likely heard of a

-

Developing a Global Export Market Strategic Plan: A Guide for Businesses

Expanding your business beyond domestic borders can be an exciting but challenging prospect. It requires a well thought-out plan, a clear understanding of the target

-

Export Import – Exim Code List

Understanding DGFT & Customs Export Import Scheme Code List in EDI Ports in India As a business owner involved in international trade, it’s crucial to

-

Graphite, manganese and vanadium ride high on soaring demand for battery minerals

The December quarter saw a flurry of activity in the Australian battery minerals space as the country is rapidly becoming a key player in the

-

Advance Export Import Business Training – 10 hours only | Training Fee : Rs 500/- per hr

Attending the One-to-One Advanced Export-Import Business Development Training with Practical is an invaluable opportunity for anyone looking to grow their trade ventures. This program is

-

Manufacturer, Supplier, Exporter & Importer – Online Free Buy/Sell Offers Listing

Online free listing directories can be a valuable resource for businesses in the import and export industry. These directories allow companies to create a profile

-

Virtual Trainers Requirement

Eximtutor.com needs Global Virtual Trainers for a part-time basis : Profile Details : 10-15 Years Industry Practical Experience in Export-Import Domain Ability to Teach and

-

Free Training Webinar On International Trade

Free Webinar on International Trade – Procedure, Marketing, Commercials & Benefits Every Month Calendar Days 9th, 15th & 24th (Timing 3.00PM-4.00PM IST)EXIM COACH & CONSULTANT

-

Exporting under GST

GSTIN/PAN and Invoice information in Shipping Bill Quoting GSTIN in shipping bill is mandatory, if the export product attracts GST for domestic clearance. Quoting PAN (Permanent Account

-

GST

GST – Goods & Services Tax Clarification on issues related to furnishing of Bond/Letter of Undertaking for Exports MyGST e-version GST Flyers GST- An Overview (In Hindi)

-

Exim Training

EximTutor’s Training Workshop in Delhi Export Business & Challenges in Export Marketing READ About the EXPORT IMPORT Business Guide Reserve Your Seat Now After Payment By

-

SDF Form Declaration in Exporting

SDF Form – Declaration under Foreign Exchange Management Act,1999 SDF [See Regulation 3(1)] (In duplicate) Shipping Bill No. : Date: Declaration under Foreign Exchange Management

-

PP Forms

PP Forms for Postal Exports The manner of disposal of PP forms is the same as that for GR forms. Postal Authorities will allow export

-

Challenges in Exporting

Working an Exporter, there are crucial challenges with Export Business : Extra Costs : There in Exporting always challenges and fear of extra cost in

-

Founder’s Welcome Message

Dear Future Learner, We are thrilled to have you on our website today. If you’re looking to pave the way for a successful career in

-

What is GSTIN ?

GOODS AND SERVICES Know how to apply for GSTIN | What is GSTIN ? IDENTIFICATION NUMBER (GSTIN) Given the buzz around Goods and Services Tax,

-

QUANTITY CODE LIST

QUANTITY CODE LIST Unique Quantity Code Unique Quantity Code Desc. BOX BOX BTL BOTTLES BUN BUNCHES CBM CUBIC METER CCM CUBIC CENTIMETER CMS CENTIMETER DOZ

-

Payment Terms

Export Payment Terms Export payment terms are an essential aspect of international trade that determines how payment for goods or services will be made between

-

GST Rate Schedule For Goods

GST RATE SCHEDULE FOR GOODS [As per discussions in the GST Council Meeting held on 18th May, 2017] The fitment of rates of goods were

-

Export Import Business Best Books for Learners |eBook and Digital Learning

Global Learner’s Choice Export Import Business Best Books Export Import Business Guide – Paperback | Export Import Business Guide: Global Self

-

Rate of exchange of conversion of the foreign currency with effect from 3rd March, 2017

Rate of exchange of conversion of the foreign currency with effect from 3rd March, 2017 GOVERNMENT OF INDIA MINISTRY OF FINANCE (DEPARTMENT OF REVENUE) (CENTRAL

-

Export Import (Exim) Business Guide

About Exim Business Guide Book My (Author Mahipat Singh) longtime career in FOREIGN TRADE & IT, encouraged me to write this book “Export Import Business

-

Connect with Global Importers and Boost Your Business with Demand-Based EXIM Research

Are you looking to expand your business and reach new markets? The key to success in international trade is finding the right buyers for your

-

Worldwide Buyers or Importers Name with HS Code List – Research Report

Welcome to our comprehensive research report on the worldwide buyers or importers name with HS code list. Our team has conducted extensive research to provide

-

Find Region Wise Buyers or Importers

INTERNATIONL BUYERS AND SUPPLIERS| EXPORTERS OR IMPORTERS in IN WORLDWIDE. REGION : EU COUNTRIES Find Buyers or Importers in Austria Find Buyers or Importers in

-

Export Import News

GOVERNMENT OF INDIA MINISTRY OF FINANCE (DEPARTMENT OF REVENUE) (CENTRAL BOARD OF EXCISE AND CUSTOMS) Notification No.12/2017 – Customs (N.T.) New Delhi, dated the 16th February,

-

Export Import News January, 2017

15-February-2017 17:49 IST INDIA’S FOREIGN TRADE: January, 2017 I. MERCHANDISE TRADE EXPORTS (including re-exports)

-

Export Scheme Code For Various Export Business Promotion Schemes

Updated Export Import News Scheme Code Exim Scheme Description 00 Free SB Involving Remittance Of Foreign Exchange 01 Advance License With Actual User

-

Know the Purpose, Get Benefits of Export Import Business Book

The Export-Import Guide Book is a game-changer for those who are interested in Foreign Trade or International Trade. It provides a comprehensive and practical approach

-

EXIM Help Desk _ Supporting to Exporters and Importers

EXIM Help Desk for Exporters and Importers This Exim Help Desk is supporting to Exporters Importers related to EXIM Business issues, complaint and suggestions for

-

STATE CODES

ITC (HS), 2012 – Schedule 2 – Export Policy STATE CODES All the exporters are required to indicate the state of origin of their export product

-

Export Promotion Schemes Codes

Scheme Code For Various Export Promotion Schemes Scheme Code Scheme description 00 Free SB Involving Remittance Of Foreign Exchange 01 Advance License With Actual User

-

Indian Customs Duty Calculator

Indian Customs Duty Calculation – Example BCD AIDC CHCESS EAIDC SWC IGST CC Total Duty Rate 25 25 0 0 10 3 0 38.406 The

-

Mandatory Documents Required For Export And Import Reduced To Three Each

Mandatory Documents Required For Export And Import Reduced To Three Each India took a leap forward in improving ‘Ease of Doing Business’ today by reducing

-

Import Export Through Courier

Know How To Import & Export Through Courier Importing and exporting goods through courier can be a convenient and cost-effective way for small businesses and

-

Sanitary Import Permit

Cases requiring Sanitary Import Permit Where import of meat and meat products of any kind including fresh, chilled and frozen meat, tissue or organs of

-

MEIS Merchandise Exports From India Scheme Benefits

MEIS Export Incentives / Benefits Guide MEIS Relevant Notification & Public Notices : Harmonising MEIS Schedule in the Appendix 3B (Table-2) with ITC (HS),

-

Generalised System of Preferences (GSP)

GSP is a non-contractual instrument by which industrialized (developed) countries unilaterally and based on non-reciprocity extend tariff concessions to developing countries. Following countries extend tariff

-

Foreign Trade Agreements of India

The list of the FTAs that have been signed by India are: India – Sri Lanka FTA Agreement on South Asian Free Trade Agreement (SAFTA)

-

Registration- cum- Membership Certificate – RCMC

An exporter may, on application given in ANF 2C register and become a member of EPC. On being admitted to membership, applicant shall be granted

-

Modern Global Export Marketing Methods

Modern Global Export Marketing Methods – Digital & Social Media Web technology and its impact on trade electronic devices and platforms continue to grow in

-

Export Import – Exim HS Code, Harmonised System Code – ITC (HS Code)

ITC HS Code List of Indian Exim HS Classification, CTH, Harmonized System Code Indian Trade Classification Harmonised System (ITC HS Code) 2017 Chapter 1: Live

-

Online Advertising Pricing

EximTutor.com Online Advertising Pricing EximTutor.com offers effective online advertising pricing for businesses seeking to promote their products or services to a wider audience. Our website, www.eximtutor.com,

-

Export Import – EXIM Business Risk Management

International business and trading – involving export and import – although quiet an attractive option, is also full of uncertainties and perils, so before stepping

-

Letter of Credit (L/c)is a international transaction document in Foreign Trade

About Letter Of Credit A Letter of Credit is a international transaction document in Foreign Trade, involving between Buyer and Seller, middle involving banks are

-

Export Promotion Councils under Department of Commerce

Export Promotion Councils under Department of Commerce ENGINEERING EXPORT PROMOTION COUNCIL Address :Vanijya Bhawan, 1st Floor International Trade Facilitation Centre 1/1, Wood Street Kolkata –

-

Refund Policy

To all Online Payment Visitors/Subscribers, we respect to your money and purpose of availing to our services. We made our successful efforts to provide you

-

Services Exports from India Scheme (SEIS) -Schedule under Appendix 3D

Annexure to Appendix- 3D Note 1:.The services and rates of rewards notified against them shall be applicable for services export made between 1-4-2015 to 30-09-2015 only. The list

-

About Exim Tutor Founder

Mahipat Singh is an Export and Import Trainer and Consultant and the Founder of EximTutor.com. He consults businesses on a wide range of International Business aspects and helps

-

Baggage (Amendment) Rules, 2006 (Baggage Rule, 1998)

[Notification No. 30/98-Cus. (N.T.), dated 2-6-1998 amended vide Notification No. 50/2014-Customs (N.T.) dated 11-07-2014, 84/2013-Customs (N.T.) dated 19-08-2013, 25 /2013-Customs (N.T.) dated 01-03-2013, 37 /2012-Customs

-

Thanks To Submit Your Payment

Dear Visitors Thanks to Visit www.eximtutor.com and submit your online payment through PayPal. We will confirm your payment transaction will deliver you Services or eBook

-

EximTutor – Consulting | Advisory | Training

Empowering Global Trade Excellence! International Market Entry & Export Growth Advisor for Manufacturing & Industrial Companies At EXIM Tutor, we offer specialized Consultancy and Advisory

-

Export Import Business Digital One-To-One Export & Import Coaching Session

Learn Export Business from the Comfort of Your Home Our Customised Training Fee is Rs. 5000/- for 10 Classes / 30 Minutes each session. Are

-

FAQs

Export Import FAQs Post to your Export Import Relevant Questions Send us Your Query or Question About Export Q1 : What is an Export Business

-

Lead Generation

Export Business Lead Generation Generating export leads is a complex process that requires expertise and a keen understanding of the market. It’s not simply a

-

Export Import Research

Export Import Research Conduct Going by universal doctrine, “An army with a comprehensive recce has strategic advantages over it rivals”. Selecting medium of exploring markets

-

Online Training for Export marketing and documentation expert

Documentation is surely another complex operational area that needs to taken up carefully. This is one area that cannot be ignored with so many dependent

-

Export Import Business Training | Know How To Start Export Import Business

Export Import Business Training And Exim Tutor’s Book: Global Self Learner’s Choice Welcome to Exim Tutor’s Book – Global Self Learner’s Choice. This book is